One of my favourite things to originate is riff on Bay Assert true estate and tech — of all kinds, residential, commercial, retail … and Justin Bedecarre has been working with San Francisco founders for practically a decade within the commercial true estate market. He’s now a founding father of HelloOffice, a expertise-powered commercial true estate brokerage. We voice about what 2017 holds for the accumulate 22 situation of commercial market.

Q: Train me what you originate.

Our total diagram is to earn procuring for accumulate 22 situation of commercial apartment smarter and sooner. We’ve changed the total PDFs, spreadsheets and bureaucracy. We have a platform to collaborate with our customers and address your total deal from initiate to signing. We also come from the realm of startups and true estate brokerage. We have each and every pedigrees. We’ve walked in our customers’ sneakers. The storylines we’ve experienced individually are truly relevant.

Q: What’s an instance?

Let’s direct you’re a company that’s simply raised a $20 million Series B and you will want 20,000 sq. toes and you’re shifting up from 5,000 sq. toes. You wish apartment that could apartment 200 these that you’re both going to outgrow or by no device maintain and sublease within the next 18 to 24 months.

In this market, you’re attempting at 5-one year leasing affords that doubtlessly discover $1.5 million a one year. Can private to you might possibly perhaps presumably presumably even be no longer a success and must steal one more round to satisfy your total hire, you might possibly perhaps presumably presumably also exercise up to $1 million simply in security deposit.

You’ve simply dedicated to spending $10 million. You’ve simply wiped out half of your round on a hire!

Q: That’s crazy.

So within the event you might possibly perhaps presumably presumably also figure out ways that corporations won’t must originate that — and that’s what we’re in a location to originate by device of procuring for two-one year subleases, lumber-and-play and completely furnished spaces — the cost savings are crazy.

Q: Why does the market calm originate 5-one year affords even these are clearly a miserable fit for the life-cycle of tech corporations?

The chips are stacked towards startups. Most startups don’t must originate these affords. At this stage, it doesn’t earn sense except there might possibly be a truly uncommon opportunity. However the exchange is built round longer-term affords.

For the landlords, turnover charges money and downtime, severely if they’ve to speculate money in building out the apartment. Construction charges private skyrocketed since Title 24 went into originate, that can add an additional $25 per sq. foot to a invent out.

For brokers, we’re incentivized to originate longer-term affords. Like I said, the chips are stacked up towards startups in relation to leasing accumulate 22 situation of commercial apartment, no longer to speak that rents are truly excessive correct now, and so landlords must lock in these rents. The complete exchange is in preserving with longer-term leases. Five years, by the manner, is not any longer that long. Fresh York leases are on occasion 10 years. SF landlords look for at seven years as a future.

Structures are sold and sold on anticipated hire phrases of that dimension — coupled with the truth that it’s the head of the market.

Q: How originate you know we’re at the head of the market and what must calm founders originate to devise round that?

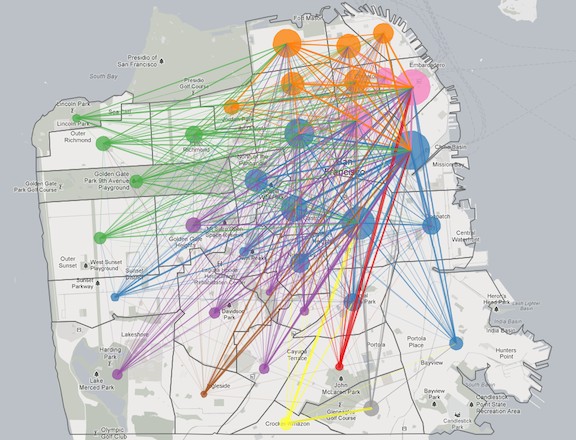

First of all, rents private plateaued and private stayed that manner for many of 2016. The excessive was as soon as the third quarter of 2015 and reasonable rents are $72 per sq. foot sometime of the metropolis.

I judge, on the change hand, that with all of these stats, every thing deserves context. Can private to you’re east of 4th boulevard, you’re attempting at $72 to $76 rents. Can private to you’re west of 4th boulevard, you’re attempting at $60 to $62 rents. Then down on ninth boulevard, you are going to private got corporations esteem Planet Labs, Code For The usa and Thumbtack, which private comely spaces at principal more cost effective rates. These form of corporations bought locked into longer leases in 2015, on yarn of tenants had so a lot much less leverage then.

However we’re also seeing shut to about one million sq. toes of subleased apartment. Subleasing is the extensive story of 2016. We’re going to space a yarn for added subleased apartment than any assorted one year within the metropolis’s historical previous.

Q: What does that imply?

The biggest story of 2016 has been subleasing. Can private to you look for many effective at the series of subleases that come to market, it’s easy to employ that as a adverse indicator of the final market and economy. Other folks are pondering, “Companies are downsizing — the market must calm be turning!” However that is most efficient fragment of the image. You’ve got to also look for at whether or no longer these subleases earn leased by assorted corporations.

No longer every company goes to work. Right esteem with talent, the cause the Bay Assert talent pool is so solid is that there are assorted places to pass if a company doesn’t work out. It’s the identical thing for accumulate 22 situation of commercial apartment. The subleased apartment that goes within the marketplace is getting stuffed, within the event you look for at the total image.

So within the event you’re angry about doing a Series B round, and you’re attempting at a 5-one year hire that sends $10 million out the door, there are two ways of facing that.

You would also warehouse apartment, address shut down 25,000 to 35,000 sq. toes and sublease 20,000 to grow into later. That can work, but it’s perilous. Or you might possibly perhaps presumably presumably also device to proceed in two to about a years with the mentality that here is not any longer going to be that principal money and you might possibly perhaps presumably presumably also salvage a subtenant to maintain it.

Some founders are pondering that $10 million is rate so a lot extra to them now than this could presumably even be later, severely on yarn of many corporations aren’t a success. Can private to you might possibly perhaps presumably presumably also exercise $3 million on sub-leasing with a lumber-and-play apartment, that’s an additional $7 million you’ll private to exercise on talent.

I’d direct with most corporations we are waiting for, they need one more round of financing to satisfy the hire duty. So there’s an limitless amount of stress from in all places the build because the board expands and as corporations private to rent.

Q: If we’re at or attain or previous the head of the market, what occurs when the accumulate 22 situation of commercial market weakens? Like what came about last time after the dot-com bust?

Other folks had been doing affords within the $120 to 130 a sq. foot vary abet then. Companies had been doing long-term affords for spaces they by no device fervent about zero earnings.

We voice about this so a lot. It is assorted this time. Something goes to happen, but it’s no longer going to be all of these corporations failing concurrently on yarn of they didn’t private legitimate industry gadgets.

Which can be the case with some. A amount of our customers are no longer a success but they’ve a route in direction of it, and heaps of the identical landlords are calm round and they’re no longer doing the affords they did in 2000. Right here is not any longer that. Right here is not any longer the dot-com era.

Q: However pastime rates are rising and that shifts the balance of how capital is allocated between perilous and never more perilous assets. Then there’s the unique administration and no topic unpredictable outcomes it will also private on fairness markets and the IPO window. So what came regarding the last time round?

So if we’re at $72 as of late, you might possibly perhaps presumably presumably also look for at each and every aspects of the cycle. In 2009, individuals had been doing affords at $19 a sq. foot at 410 Townsend, which is the TechCrunch building. Five years later, it was as soon as $70.

That location caught each and every aspects of the enhance. SOMA wasn’t what it’s as of late. If you happen to are waiting for all of these cranes in SOMA, you earn this sense that there’s a form of apartment.

Q: However the unique constructions being built are largely pre-leased, correct?

No longer all of it. Over the next two years, 4,500,000 sq. toes of latest constructions will come on-line, and lower than half of of that is spoken for.

Q: That’s esteem 30,000 workers’ rate of accumulate 22 situation of commercial apartment. We’re most efficient slated to voice on about 3,200 housing units next one year, after which 2,500 in 2018. Proposals for even newer projects private fallen to a four-one year low on yarn of true estate builders are ready to are waiting for the build the metropolis’s unique affordability necessities will fall. Voters handed an initiative over the summer to steal them so that 25 percent of every mission is below-market-rate.

However a metropolis controller scrutinize said here is honest too excessive and is financially infeasible. Landowners can also no longer sell to builders at that level on yarn of it doesn’t buy them out of their modern money flows of no topic businesses currently diagram on their property, esteem gasoline stations, or builders can also resolve that they’ll’t spread the cost of producing cheap units — that can also discover round $700,000 to 800,000 a unit to invent — sometime of the cost of the market-rate units. And if builders query to lose money, they won’t invent. So that simply advantages the monetary pursuits of the present property and house owners within the metropolis, since the shortcoming is exacerbated.

The Board of Supervisors private assign themselves in a good accumulate 22 situation. It’ll look for sinister politically if they lower the affordability threshold from 25 percent. On the change hand, it’s imaginable that with the California explain density bonus legislation, they’ll also come to a compromise that maintains that amount but awards height bonuses to earn there.

Entirely. It’s simply too costly to live and work within the metropolis. This could no longer simply force individuals to live within the encircling cities and commute in, this could presumably force corporations to space up workplaces out of explain.

Q: No longer every tech company wishes to be within the Bay Assert. There are a form of varied enormous American cities. On the change hand, I judge the premise that you might possibly perhaps presumably presumably also simply discontinuance building housing and that the exchange will earn squeezed out and pass in assorted places is naive. What truly finally ends up taking place is that corporations pass their heart-profits jobs, esteem gross sales and yarn administration, to lower-discover American cities esteem Phoenix and withhold their executive and extremely compensated technical jobs here within the Bay Assert. It truly entrenches this overarching pattern of the shortcoming of the center-class within the build.

That’s exactly what’s taking place. All individuals’s doing it. Gusto is increasing in Denver, Thumbtack is adding in Salt Lake City and Metromile is doing it in Tempe, Arizona.

Q: On the least, I was as soon as finding out that many of the accumulate 22 situation of commercial apartment was as soon as pre-leased earlier when individuals had been fervent we had been running up towards 1986’s Proposition M, which caps the amount of accumulate 22 situation of commercial apartment that is also built in SF in any single one year.

The looming Prop. M cap inspired a form of landlords and builders to invent, as you might possibly perhaps presumably presumably also are waiting for by the total cranes round SF, severely in SoMa and Downtown. If your building was as soon as coming on-line in 2015, it was as soon as pre-leased. The constructions coming on-line in 2017 and 2018 private had a more difficult time, but that’s no longer to claim they won’t hire up.

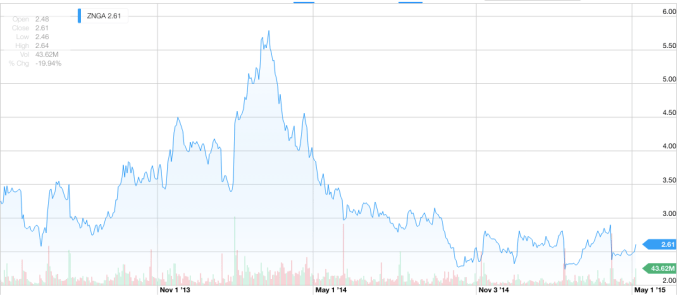

It’s simply that 2015 leasing market was as soon as crazy. After which LinkedIn crashed in early February of 2016 shedding half of its discover in at some point, I judge it was as soon as a Friday, and that was as soon as a turning point within the market. Perception changed from the market being unstoppable to founders and their patrons having uncertainty. VCs became outspoken and startups reduce charges, and things started to normalize within the true estate market, and we ended up having a truly real, wholesome one year in leasing.

Every 181 Fremont and Salesforce Tower are topping out rapidly, and private extra than one million sq. toes on hand between the two of them.

Half of 350 Bush is calm on hand. The assorted half of of that building is Twitch. After which there are two extra towers. One bought accredited and the assorted broke floor. You’ve got the Flower Mart being developed, tower going up on Townsend and 4th correct sometime of from the Caltrain. You’ve got the trends in Dogpatch esteem Pier 70, Hooper and naturally the Warriors. Lots is getting performed this cycle.

However there are also calm challenges. We would like the sq. photographs. Extra corporations are coming to SF and these corporations are staying. It wasn’t forever the case that tech corporations had been headquartered in SF. They’d initiate here after which they’d proceed and scale in Silicon Valley. A amount of that changed with Marc Benioff committing to SF. Then after Salesforce, there was as soon as Zynga.

Q: Which owned a building that at last became rate extra than its industry….

Mark Pincus has forever been orderly savvy on true estate. After Zynga, there was as soon as Twitter, which secured a tackle employee tax incentives in mid-Market.

Q: By the manner, these Mid-Market tax incentives are space to quit in 2018, and presumably sooner if the Trump administration makes factual on its promise to revoke funding from “sanctuary cities.” So if that occurs, San Francisco will must face up for foregone earnings.

Oh, OK. After which Pinterest is building a campus. Stripe is building a campus. Uber has scaled vastly. There’s also Airbnb. These corporations which is also paying a form of money to scale in SF.

Other folks must live in SF, but it’s getting more difficult and more difficult. So this could presumably even be attention-grabbing to are waiting for what occurs within the next cycle when the talent can’t come up with the money for to live here. Can private to you’re essentially essentially based in SF, you might possibly perhaps presumably presumably also pull from East Bay talent, Silicon Valley talent, SF after which the North Bay. That’s why it’s so crucial. It’s the hub.

Q: Isn’t it since the orderly corporations esteem Google, Facebook and Apple private on occasion exhausted a whole lot of the apartment within the peninsula too? Like sure spaces in Palo Alto are north of $100 per sq. foot, which is manner increased than what you are waiting for in SF.

Two of the three most costly streets in The usa for commercial true estate are within the Bay Assert. One is Sand Hill Avenue in Menlo Park and the assorted is Hamilton Avenue in Palo Alto. Facebook and Palantir became the anchors sometime of this cycle and had been the most attention-grabbing unique corporations that had been in a location to scale to any orderly level. There are also smaller corporations esteem SurveyMonkey and a handful of others in Palo Alto.

However there’s calm a form of apartment within the rest of Silicon Valley. I don’t judge it’s a supply voice. I judge that fewer individuals must hump to Silicon Valley to work. However all of these corporations are scaling previous — manner, manner previous — the amount of these that could live here.

Q: What originate you imagine had been the biggest accumulate 22 situation of commercial affords of the one year?

- Twitch was as soon as a large one. They leased 185,000 sq. toes in a building that isn’t even built but. It’s been out of the ordinary to are waiting for them grow from their roots as Justin.tv from the first Y Combinator class.

- Then when Twitter assign their apartment out on the subleasing market, it was as soon as taken up by NerdWallet and Thumbtack. So that’s a truly factual instance of what a wholesome market looks esteem. These corporations took profit of lumber-and-play, completely furnished apartment.

- Then there was as soon as Charles Schwab — staying, in wish to leaving. That was as soon as a large deal. They took 400,000 sq. toes at 211 Main after issues they had been going to pass to a more cost effective market and proceed their fatherland.

- For the East Bay — and I’m no longer an expert there — there was as soon as the Uber deal.

Q: It’s attention-grabbing that a form of individuals aren’t truly being attentive to what came about after the Uber deal. So Lane Partners, the developer that sold the Sears building at nineteenth Avenue BART for $25 million in 2014, assign $40 million of renovation work, then sold it to Uber for $123.5 million the next one year, they simply proposed one more huge deal at the quit of November. They pitched a 1.3 million sq. foot deal, which is extra than three cases the size of the Uber building, one block away.

Oakland’s vacancy is 5 percent. It’s truly, truly tight. It’s completely about supply.

Q: However Oakland has historically had many entitled accumulate 22 situation of commercial projects. However few projects are truly being built.

That’s on yarn of it’s simply as costly to invent there as in SF, but you earn principal much less in rent.

There’s so many macro-level factors. Will SF calm be as attention-grabbing when the talent can’t come up with the money for to be here? Transportation is a predominant element round the build constructions are being built. It has to be unprecedented with how many extra individuals are coming downtown and we on occasion private the identical transportation device from 50 years within the past, and an analogous ranges of parking.

I’m truly fervent about seeing how the transportation adjustments over the next cycle.

Q: I’d wager on autonomy earlier than the infrastructure improves. We handed a $3.5 billion BART bond within the last election, and it entails some funding to scrutinize a 2d transbay tube, but that can address shut about a decades to full if we’re a success.

Wow.

One assorted voice we’re seeing is that the metropolis has started to crack down on zoning. They space up a zoning activity force.

Q: Right here is between accumulate 22 situation of commercial and industrial or PDR (manufacturing-distribution-restore) apartment, correct?

Yeah.

Q: The cause they created that class a few decade within the past is on yarn of they wanted a combine of makes employ of. Within the last cycle, accumulate 22 situation of commercial was as soon as cannibalizing all these former industrial spaces, which was as soon as undercutting extra of this heart-profits job putrid that sits in between white-collar accumulate 22 situation of commercial work and restore labor, which is extremely low-wage. While the metropolis has leaned very closely into tech, you don’t private to be all tech. A metropolis wishes to private a assorted basket of industries and jobs, simply similar to you’d private in a monetary portfolio. Protecting sure forms of apartment ensures that. In some other case, actually every thing becomes condos and accumulate 22 situation of commercial on yarn of that’s the most realistic-discover employ of the underlying land.

On the one hand, I earn it. However it creates assorted problems. Industries inclined and switch after which you might possibly perhaps presumably private got these dying industries and you might possibly perhaps presumably presumably also’t regulate since the regulations are in accumulate 22 situation to the build tenants can’t hire a building.

Q: On the assorted hand, the PDR class inadvertently created apartment for hardware startups that trades at something esteem 30 percent reduce rate per sq. foot when in contrast to pure utility startups.

Yeah, that’s enormous. However it’s the manner that here is enforced and has change into politicized. For a protracted time, this wasn’t an argument. Then all of a surprising it was as soon as and heaps corporations bought injure. They had been in spaces that they didn’t know they weren’t zoned for, then they bought a call and had been kicked out.

Then the assorted voice is figuring out apartment for non-profits. ECS (Episcopal Neighborhood Services) is one amongst our customers.[[Editor’s speak: ECS is a nonprofit that, among many change things, runs a program coaching individuals experiencing homelessness to alter into restaurant chefs.]

ECS was as soon as scouring the market for a apartment that they’ll also come up with the money for, and the most attention-grabbing ones that qualified had been skirting the strains of what was as soon as correct. They determined no longer to pass down that route but it was as soon as laborious.

Q: What’s the nonprofit market esteem?

It’s laborious. A amount of nonprofits are paying within the children and twenties and private leases expiring rapidly. We’re engaged on some initiatives to leverage our platform to earn the orderly tech corporations to provide and match extra apartment to nonprofits that need it.

Q: What must calm you originate about accumulate 22 situation of commercial apartment within the event you’re a founder and you’re planning to enhance?

As soon as I judge about corporations that must enhance, I judge a few hermit crab. The shell you’re in now could presumably be no longer going to be the shell that you’re in two years from now. Optimize round shorter-term lumber-and-play apartment. You would also calm earn it your dangle, and you protect capital to put money into talent, which is extremely crucial.

Q: What within the event you’re downsizing?

If you happen to imagine about corporations which is also downsizing, you will want to earn your apartment as lumber-and-play as imaginable. By no device over-optimize round making yourself total again. Slice again the injury, reduce your losses, and pass onto the next thing. It’s calm a factual time to sublease. There’s heaps of assign a query to available so long as you accumulate 22 situation it precisely

Q: What’s the advice you withhold having to repeat over to founders procuring for apartment?

- Give yourself enough time to search. We’re on occasion having that dialog with founders manner too gradual. Can private to you’re procuring for the rest round 2,500 sq. toes and above 5,000 sq. toes, give yourself no longer lower than three months. If you happen to truly boil it down, it most efficient takes about a weeks to are waiting for spaces. However what if these spaces don’t work out, then it be crucial to abet for one more moderen supply of apartment. Can private to you undercover agent a apartment in two weeks, it takes one more two weeks to negotiate after which it be crucial to space up Cyber web and furnishings.

- You should always calm yarn for $15 per sq. foot on the low-quit and $25 per sq. foot on the excessive-quit for furnishings. If the apartment isn’t wired, then I’d direct yarn for $30 per sq. foot in space-up charges.

- The biggest thing when drawing attain a search is figuring out what your headcount goes to be in 18 to 24 months. For startups, that’s as a ways out as they’ll predict. I’d apply 100 sq. toes-an-employee to the head quit of that.

Q: No longer 150?

- No. You would also positively earn apartment to fit that, but you don’t private to be swimming in it whereas you happen to’re smaller. 150-sq.-toes-per-person is a factual benchmark for the build you will want to be at a real rate, but startups are no longer real.

- Realize the build your workers are coming from, or the build you will want to recruit from. Realize whether or no longer it be crucial to be round Caltrain or BART, as an example. Can private to you’re coming from the South Bay, you’re doubtlessly no longer going to join a company in Jackson Square.

Q: What regarding the impact of apartment to your organization culture?

We talk so a lot about what the dynamic of your crew is from engineering to gross sales to operations. Some engineers favor to be isolated. Some favor to be extra collaborative.

You should always calm discover the dynamic of the manner you will want individuals to have interaction and the manner you will want individuals to meet and flee into every assorted. That can dictate what form of apartment and vibe you’ll private and what the most attention-grabbing layout is.

It’s positively a balance. The 2 things that workers complain about are no longer having enough toilets and no longer having enough assembly apartment. You’ll will must private a balance of telephone booths, puny assembly rooms and a restricted series of better assembly rooms. You wish apartment that enables individuals to flee into assorted environments. If a large fragment of your culture is having meals with the crew, then it be crucial to invent round that.

Q: What about birth accumulate 22 situation of commercial plans?

I judge there’s no perfect device to that.

Q: What about having a truly polished accumulate 22 situation of commercial apartment that makes you might possibly perhaps presumably presumably even be feeling similar to you’ve arrived presumably whereas you happen to haven’t but?

The vibe and message that you truly must ship with the accumulate 22 situation of commercial is a trailing indicator. The accumulate 22 situation of commercial doesn’t make clear the corporate culture. The culture defines the accumulate 22 situation of commercial.

A amount of our customers private the mindset that they don’t want individuals to feel esteem they’ve made it. They private to feel scrappy. However it be crucial to earn sure there’s a balance between having a warehouse feel and private it feel productive.

Q: Build you are going to private got any predictions for 2017?

I don’t know if here’s a cop-out, but I judge it’s going to be a real one year. Things will aloof down by manner of the knowing of creating when 181 Fremont and Salesforce are executed.

Q: Gigantic towers are usually lagging indicators. The last tallest tower we had in this metropolis was as soon as the Transamerica Pyramid, which was as soon as 1972, the one year earlier than the Oil Crisis. Then within the event you look for at Fresh York, the Chrysler and Empire Assert Structures had been executed or nearing completion round the 1929 wreck.

That’s on yarn of it takes so rattling long to invent. Developers aren’t investing in this cycle. They’re investing within the next one.

This one year despite the truth that, it’s laborious to claim. Endeavor is not any longer shutting off this one year. These funds are manner too enormous. So something that we don’t be taught about has to happen.

We’re a factual distance a ways from when LinkedIn crashed, and every person tightened up, reduce charges and began focusing on getting to profitability. The biggest corporations within the market are ones esteem Slack, that aren’t confirmed and aren’t sure things. However they are making a form of money and private a form of investment at the abet of them.

Then you’ve bought Uber, which is a predominant, predominant tenant and would be a driver of jobs in Silicon Valley, the East Bay and San Francisco going forward at a principal better scale. They increased their native headcount by extra than 80 percent in 2016.

And you might possibly perhaps presumably presumably also private got Salesforce, the biggest tenant within the metropolis, with extra than 6,000 workers. As soon as they combine into that single tower, they’ll proceed a whole lot of hundred thousand sq. toes of accumulate 22 situation of commercial apartment within the encircling location.